Lump payment on mortgage calculator

Mortgage Calculator with Lump Sums. Our mortgage calculator helps you estimate your monthly mortgage payments.

Mortgage Calculator Money

If youve received a lump-sum payment from an inheritance tax refund or commission from a sale youre probably considering how to best use the money.

. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. 4 Ways to Pay Off Your Mortgage Early. When you use this service youll see all the information you need including your remaining annual allowance if you have a fixed interest rate.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. With a few key details the tool instantly provides you with an estimated monthly payment amount. Mortgage Calculator zip file - download the zip file extract it and install it on your computer.

By increasing the monthly payment you pay off your mortgage faster and cut down on interest payments. Making a lump-sum mortgage payment isnt your only option if youre fortunate enough to have extra money. Pay this Extra Amount.

How much does it cost to recast a mortgage. The TD Mortgage Payment Calculator can help you better understand what your payments may look like when you borrow to buy a home. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. It typically costs between 150 and 500 to recast your mortgage depending on your lenders. You may also enter extra lump sum and pre-payment amounts.

Consider a lump sum payment. This is the best option if you plan on using the calculator many times over the. Use this calculator to.

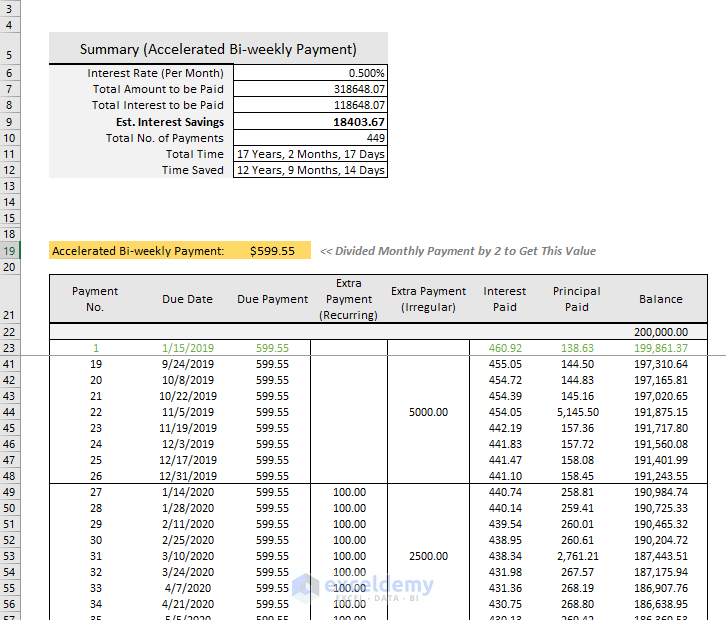

In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage. Your Investors mortgage loan will transfer to Citizens on Oct. Another payment strategy you can do is to make a large lump-sum payment.

The accelerated biweekly version will be higher at 59677. We also generate graphs summaries of balances payments and interest over the life of your mortgage. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months.

When the house is sold proceeds of the sale are split according to the share of. You can use it to test different payment scenarios depending on your amortization period payment frequency or the. So if youre currently paying 1000 per month in principal and interest payments youd have to pay roughly 1500 per month to cut your loan term in half.

For instance if your monthly payment is 119354 its biweekly counterpart is 55086. Our advanced mortgage payment calculator with PMI multiple extra payments tax and insurance. Underneath the sub menu My payments choose the make a payment Overpayment missed mortgage payment or manual mortgage payment option and select lump sum overpayment.

Well show you how to pay off your mortgage faster so you can finally join the ranks of debt-free homeowners. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. This mortgage calculator gives a detailed breakdown of your mortgage and calculates payment schedules over your full amortization.

The Vertex42 Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side. Most closed mortgage products allow a once-per-year lump sum payment of up to 20 of the remaining principal amount or balance. The HELOC payment calculator generates a HELOC amortization schedule that breaks down each monthly payment with interest and the principal amount that a borrower will be paying.

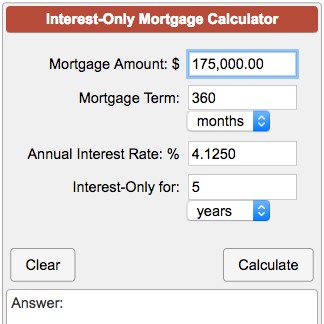

A borrower can make a one-time lump sum payment or increase his monthly payment. If you get an unexpected bonus from work or an inheritance you can quickly apply it toward the principal owed on your home. Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal.

It calculates your monthly payment and lets you include additional extra payment prepayments to see how soon you could pay off your home or how much you could save by paying less interest. Free online mortgage calculator specifically customized for use in the UK including amortization tables and the respective graphs. Youll also repay the loan sooner freeing up extra cash at the end.

How much of a lump sum payment you can make without penalty depends on the. This is the best option if you are in a rush andor only plan on using the calculator today. Before doing anything else use the above extra mortgage payment calculator and see how much you may save in the long run.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. 360 original 30-year term Interest Rate Annual. For example if youre interested in paying off your mortgage off in 15 years as opposed to 30 you generally need a monthly payment that is 15X your typical mortgage payment.

Make a One-Time Lump-Sum Contribution. Estimate your monthly payment with our free mortgage calculator and apply today. Mortgage Amount or current balance.

One such option is to make extra payments toward the principal. If your balance at the end of the year is 100000 the maximum lump sum payment for that year would be 20000. Youll pay down your loan early by 3 years and 9 months.

The accelerated amount is slightly higher than half of the monthly payment. You can easily calculate how much interest youll save by using a mortgage payoff calculator. The home loan calculator accounts for mortgage rates loan term down payment more.

Okay you probably already know that every dollar you add to your mortgage payment puts a bigger dent in your principal balance. American Financing is not a licensed financial. Th mortgage payment each year.

Adjust down payment interest insurance and more to start budgeting for your new home. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. The underpayment feature is used to.

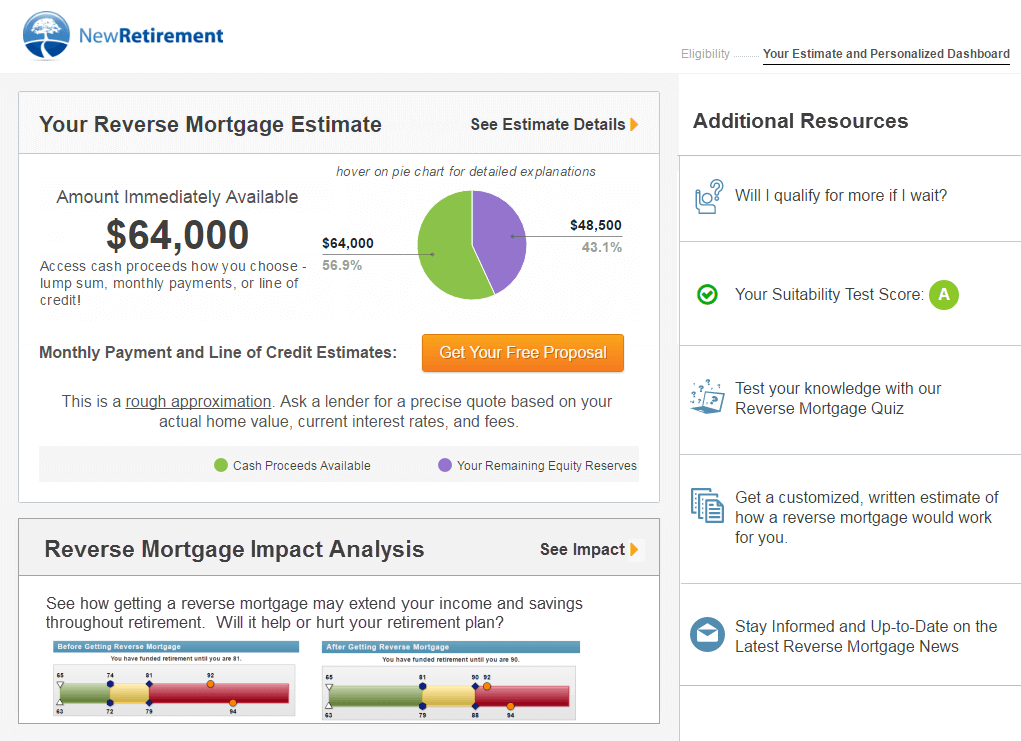

All or part of the homes equity is sold upfront at a discount with the person receiving either a monthly payment or a lump sum. Either in lump sums or as part of the regular payment process. A lump-sum payment is when you make a one-time payment toward your mortgage in addition to your regular payments.

Extra Payment Mortgage Calculator For Excel

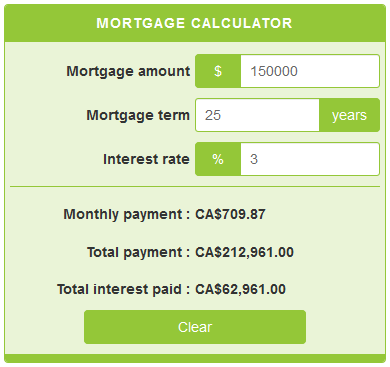

How To Use A Mortgage Calculator Comparewise

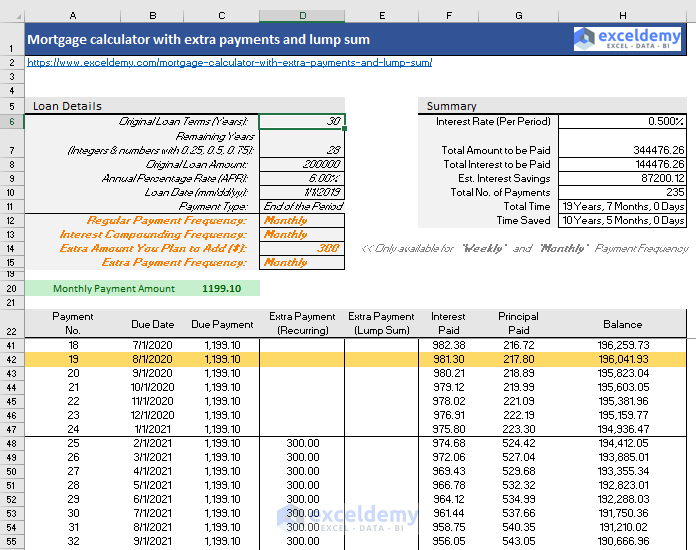

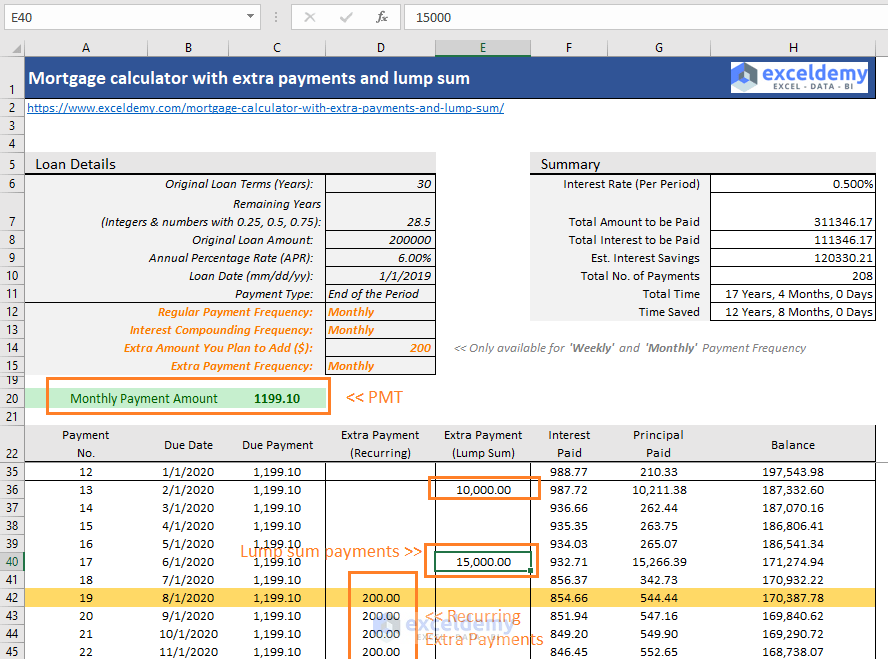

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage With Extra Payments Calculator

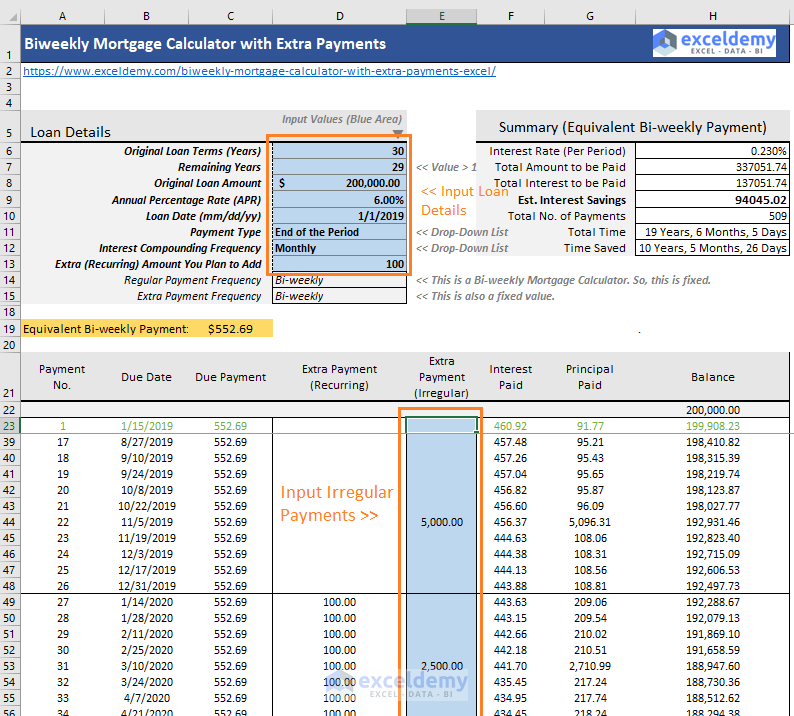

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Pin On Mortgage Calculator Tools

Mortgage Calculator With Extra Payments Payment Schedule

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Royal Bank Mortgage Calculator Deals 53 Off Www Ingeniovirtual Com

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Reverse Mortgage Calculator How Does It Work And Examples

Downloadable Free Mortgage Calculator Tool

Interest Only Mortgage Calculator

Reverse Mortgage Calculators